Retirement Planning

While it’s common knowledge that medical inflation outstrips consumer inflation year-on-year by around 3% to 4%, these are not the only healthcare costs that should be factored into your post-retirement budget. Depending on your medical aid, you may need to

To protect retirement savers from excessive risk, Regulation 28 limits exposure to certain asset classes. Currently, offshore exposure (including Africa ex-SA) is capped at 45%, while exposure to alternative assets such as private equity is limited to 15%.

Inflation may feel like a distant concern when you’re still earning, but in retirement, it becomes a silent assassin of purchasing power – keeping in mind that even modest inflation erodes the value of your income and savings over time.

Separate from day-to-day healthcare, the potential need for long-term care is a major cost driver. Whether it’s assisted living, dementia care, or full-time frail care, fees can run into tens of thousands of rands per month.

Another mistake is failing to appreciate the impact of investment risk and volatility on income sustainability. Because a living annuity is an investment, your capital is exposed to market movements, and this exposure needs to be managed carefully. Some retirees

While trustees are not personally accountable to individual members in the same way a service provider might be, they do have a fiduciary duty to the fund and its members collectively. If you’re part of an occupational fund, it’s worth

One of the primary attractions of a living annuity is the investment flexibility it offers. Because it is not governed by the Pension Funds Act, the Regulation 28 asset restrictions fall away, and you can design a portfolio without caps

Significantly, the impact of lower earnings leads to reduced access to employer-sponsored retirement contributions, lower levels of group life and disability cover, reduced ability to invest meaningfully, and a diminished ability to benefit from compound growth over time.

In terms of the Long-term Insurance Act, the annuitant may nominate one or more beneficiaries to receive the remaining value of the living annuity on death, meaning that a living annuity is both a tax-efficient estate planning tool and an

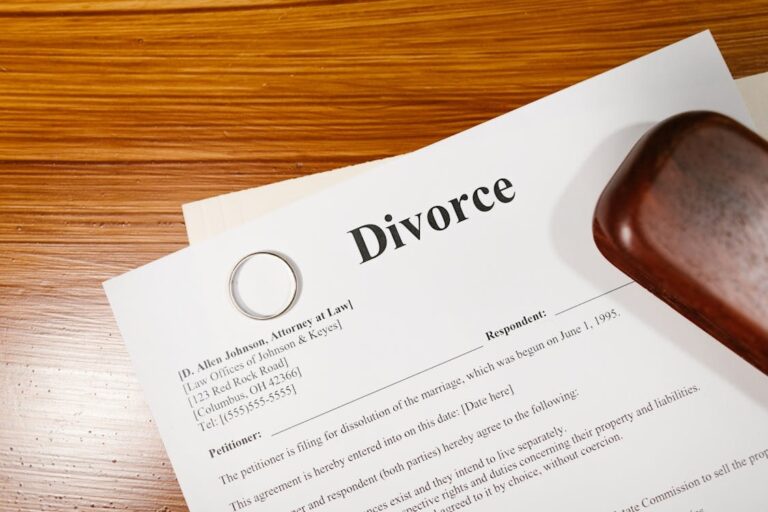

A common and costly pitfall in divorce proceedings arises from improperly worded divorce orders. As such, it’s vital to ensure that the divorce order clearly and unambiguously states the intended division of pension interest to be valid and enforceable.