Retirement Planning

Following on from the above, it’s important that investors accurately declare their over-contributions to SARS and do not mistakenly claim them as tax-deductible in the year they are made, keeping in mind that incorrect reporting can result in the disallowance

Government has long incentivised retirement savings through a range of tax concessions. Individuals are allowed to contribute up to 27.5% of their taxable income, capped at R350 000 per year, to retirement funds, including RAs, on a tax-deductible basis.

Look for creative ways to generate additional income. The gig economy has made it easier than ever to earn extra money through tutoring, freelance work, renting out a room, or offering pet-sitting or delivery services. Every bit of extra income

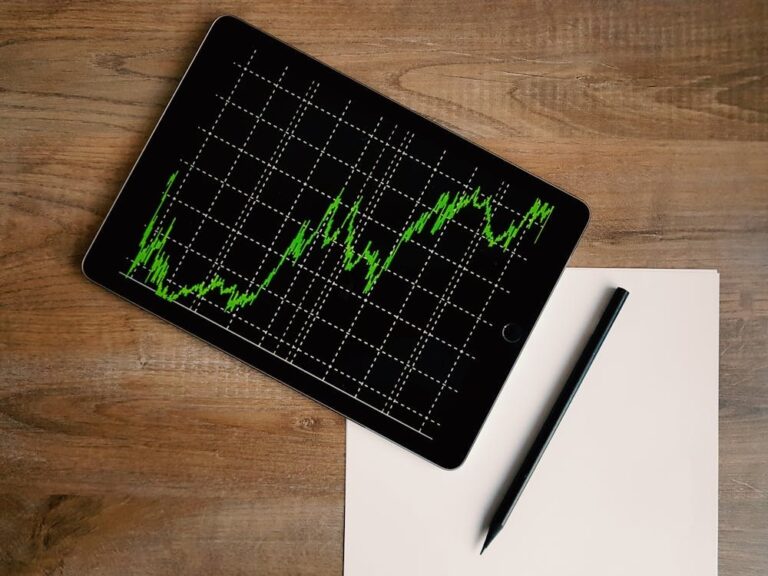

One key advantage of purchasing a living annuity with your retirement capital is that it is not subject to Regulation 28, allowing for more aggressive investment strategies, including 100% offshore exposure via Rand-denominated feeder funds. Direct offshore investing is not

Keep in mind that any and all previous withdrawals and/or severance benefits are also taken into account when calculating the total taxable withdrawal, meaning that it is a cumulative total and not calculated on a pre-withdrawal basis. As such, be

If you hold both discretionary and compulsory investments, structuring your withdrawals tax-efficiently is key to preserving your wealth. You must also manage drawdowns from your living annuity carefully to prevent premature depletion of your capital or future cashflow constraints.

Most importantly, full disclosure on your insurance application form is critical to ensure that your claim is not rejected at claims stage. Remember, even a seemingly small non-disclosure which has no relation to one’s disability can result in your claim