Will

From a cost perspective, where fixed property is transferred to another person by way of inheritance – whether testate or intestate - no transfer duty is payable, and Sars will issue a transfer duty exemption certificate upon application by the

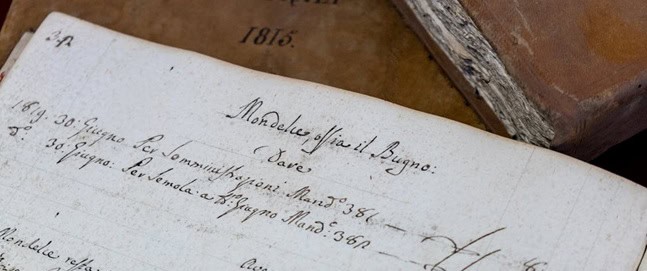

A Living Will, also known as an advance directive, is a document that outlines a person’s wishes regarding medical treatment in situations where they can no longer communicate for themselves. It allows individuals to refuse certain life-sustaining interventions if there

As a married couple, you will want to ensure that you are both adequately provided for in the event of death or disability, so take time beforehand to put the appropriate level of cover in place. If you or your

In the absence of an estate plan, problems could arise in the deceased’s estate if there are insufficient liquid assets to honour the deceased’s bequests. In order to pay the bequests, the executor may need to realise assets in the

To formalise his/her appointment, the executor must apply to the Master’s Office for what is referred to as letters of executorship which will only be issued if the Master is satisfied that the will is valid and that the nominated

A curator bonis has limited powers of investment which can adversely affect the growth of assets in the estate. The nature of the job together with generally poor remuneration means it is difficult to find appropriate candidates to assume the

Where beneficiaries have been nominated on the investment, funds housed in a living annuity do not form part of your deceased estate and can be efficiently transferred to your loved ones in the event of your death.

The death of the first-dying spouse is regarded as a disposal for capital gains tax purposes. Where the first-dying spouse bequeaths his/her share of the joint estate to the surviving spouse, the surviving spouse is treated as having obtained the

Life policies are used frequently as estate planning tools to ensure that one’s beneficiaries have access to funds in the immediate aftermath of one’s passing. However, in terms of our law, keep in mind that children under the age of