estate administration

If the executor named in your will has since emigrated, it may be wise to update your will and appoint someone based locally. This ensures a smoother estate administration process, avoiding delays and unnecessary financial burdens on your beneficiaries.

A trust can be useful for securing assets such as a family farm or holiday home for future generations, safeguarding against potential alienation or sale. In such circumstances, the trust serves as a valuable succession planning tool by ensuring that

Children under 18 cannot inherit lump sum payouts or other assets directly, as they lack the legal capacity to manage such assets. Therefore, if you intend to name a minor child as a beneficiary of a life insurance policy or

In the absence of an estate plan, problems could arise in the deceased’s estate if there are insufficient liquid assets to honour the deceased’s bequests. In order to pay the bequests, the executor may need to realise assets in the

Where bonded fixed property is bequeathed to your children, they may be required to register a bond over the property in their own name and, if they do not qualify for a bond, they may be forced to sell the

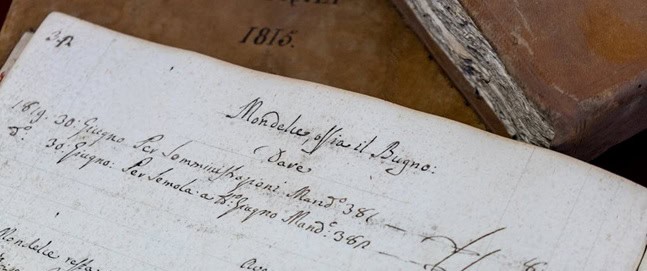

To formalise his/her appointment, the executor must apply to the Master’s Office for what is referred to as letters of executorship which will only be issued if the Master is satisfied that the will is valid and that the nominated

A common problem faced by many executors is that of illiquidity, which is where an estate lacks sufficient liquid assets to cover its debt and other financial obligations. In such circumstances, the executor will look to assets in the estate

Life insurance policies can be used to create liquidity in your estate and to make financial provision for your spouse and/or beneficiaries. However, as with other estate planning tools, it is essential to correctly structure your policy so that it

If immovable property in your estate is transferred to an heir – whether by testate or intestate succession - your estate will be required to pay the transfer costs, being the attorney’s conveyancing fees, in accordance with a sliding scale

If the Will is found to be invalid, then the deceased’s estate must be wound up in terms of the laws of intestate succession. In such an instance, the Master will appoint an Executor Dative to the deceased estate.