estate plan

A single-income family faces heightened risk in the event of job loss or retrenchment, making it crucial to implement risk mitigation strategies. One option is to consider retrenchment cover for your spouse, though this type of insurance tends to be

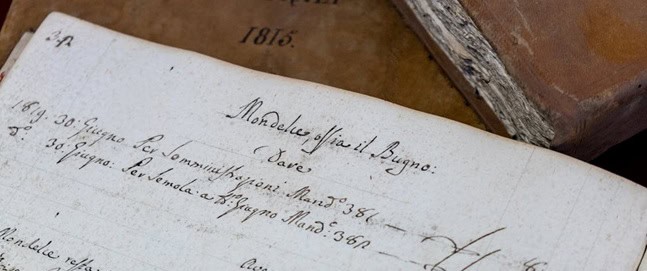

A Type A special trust is an excellent estate planning tool which is designed to take care of people who are not able to manage their own finances, such as a special needs child. A Type A special trust is

Upon marriage or entering into a long-term relationship, it is essential to reassess your life cover needs to reflect your new circumstances. If you and your spouse have acquired a home, your life cover should ideally match the value of

Many women find themselves trapped in unhappy and/or abusive relationships because they do not have the financial means to escape. As such, it is absolutely essential that every woman in a long-term relationship or marriage becomes actively involved in the

A trust can be useful for securing assets such as a family farm or holiday home for future generations, safeguarding against potential alienation or sale. In such circumstances, the trust serves as a valuable succession planning tool by ensuring that

Home nursing is unaffordable to most families and can cost anywhere between R8 000 and R30 000 per month depending on the level of care required – bearing in mind that dementia care is a specialist field of nursing which,

During the divorce process, remember that both you and your spouse retain full contractual freedom when determining a settlement. You can choose to strictly adhere to your matrimonial property regime for asset division or opt for a negotiated settlement tailored

Children under 18 cannot inherit lump sum payouts or other assets directly, as they lack the legal capacity to manage such assets. Therefore, if you intend to name a minor child as a beneficiary of a life insurance policy or

In the absence of an estate plan, problems could arise in the deceased’s estate if there are insufficient liquid assets to honour the deceased’s bequests. In order to pay the bequests, the executor may need to realise assets in the

While the proceeds of domestic life insurance policies are deemed property in a deceased estate, buy and sell cover is a notable exception. This insurance is taken out by business owners on each other’s lives so that, if one shareholder