financial planning

Few areas demonstrate the price of indecision more clearly than debt. High-interest loans left unconsolidated grow relentlessly as interest compounds. What may once have been a manageable problem quickly escalates into a burden that feels insurmountable.

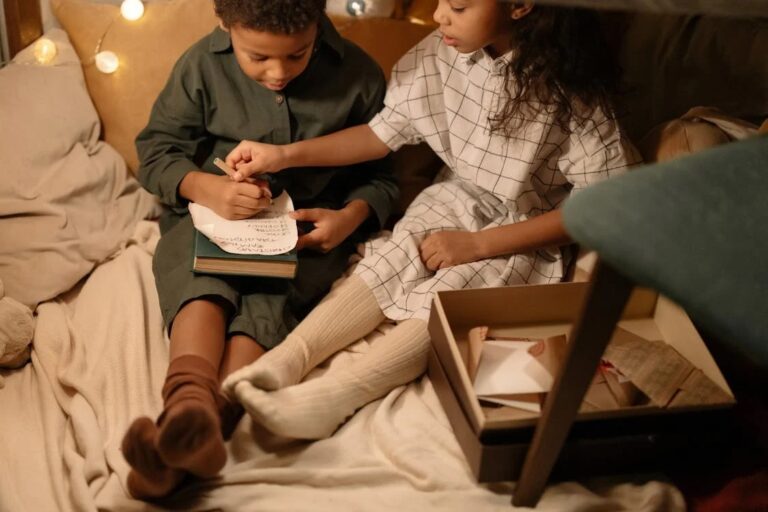

The first risk of over-providing is that of entitlement. When children never experience financial difficulty or financial limitations, they may grow to view privilege as a right, rather than a gift.

In financial planning, the pattern is consistent. Those individuals who live within their means, save diligently, and remain invested over decades often end up with more financial security than they ever expected. Their success stems not from sophisticated strategies but

If a parent dies intestate and leaves behind minor children, guardianship is usually awarded to the surviving parent. However, if both parents die simultaneously or within a short period, the Master of the High Court will appoint a legal guardian,

Underwriting is the process that life insurers use to assess the level of risk they are taking on when insuring an individual. Put simply, it’s how insurers determine whether to offer you cover, how much cover they are willing to

In terms of the doctrine of ademption, specific bequests lapse when the asset no longer exists. This can happen when the testator sells, gives away or otherwise disposes of an item before they die. Unless the will provides for substitution

In the event of your death, your Will can only deal with your half of the joint estate, making it essential to ensure that your Will is limited to distributing only your share of the assets.

Keep in mind that any and all previous withdrawals and/or severance benefits are also taken into account when calculating the total taxable withdrawal, meaning that it is a cumulative total and not calculated on a pre-withdrawal basis. As such, be

A Type A trust is designed to provide financial security for a person with a severe mental or physical disability who is unable to support themselves financially. It can be either an inter vivos trust that is set up during