financial planning

When a member leaves their employment, they have the option to leave the accumulated capital in the employer’s default investment strategy until retirement. The member also has the option of transferring the funds on a tax-neutral basis to a retirement

Many women find themselves trapped in unhappy and/or abusive relationships because they do not have the financial means to escape. As such, it is absolutely essential that every woman in a long-term relationship or marriage becomes actively involved in the

Endowments also offer tax benefits to investors with a marginal tax rate of more than 30% as they effectively reduce the tax payable on investment growth. However, they require a minimum investment term of five years, allowing for one withdrawal

Choosing the right medical scheme in South Africa can be challenging due to the wide range of options available. For network medical aid plans, an adult dependant might pay between R1,100 and R3,500 per month. Mid-range plans with good hospital

With a properly structured business assurance agreement, the proceeds from such a policy are exempt from estate duty in your estate. Unlike other assets, business assurance policy proceeds are not considered part of the deceased estate's deemed property, offering a

Avoid relying on your spouse to fund for your retirement. Investing towards a comfortable retirement requires careful planning, time, and a commitment to regular saving – and relying on one person to save sufficiently for two people’s retirement can be

Children under 18 cannot inherit lump sum payouts or other assets directly, as they lack the legal capacity to manage such assets. Therefore, if you intend to name a minor child as a beneficiary of a life insurance policy or

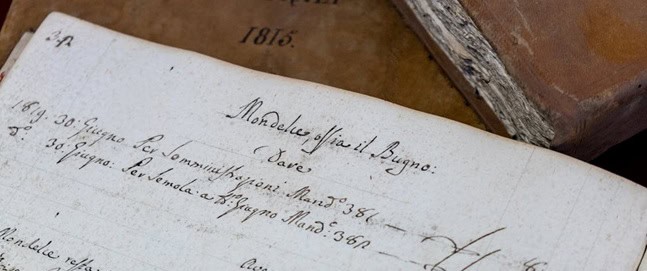

In the absence of an estate plan, problems could arise in the deceased’s estate if there are insufficient liquid assets to honour the deceased’s bequests. In order to pay the bequests, the executor may need to realise assets in the