retirement plan

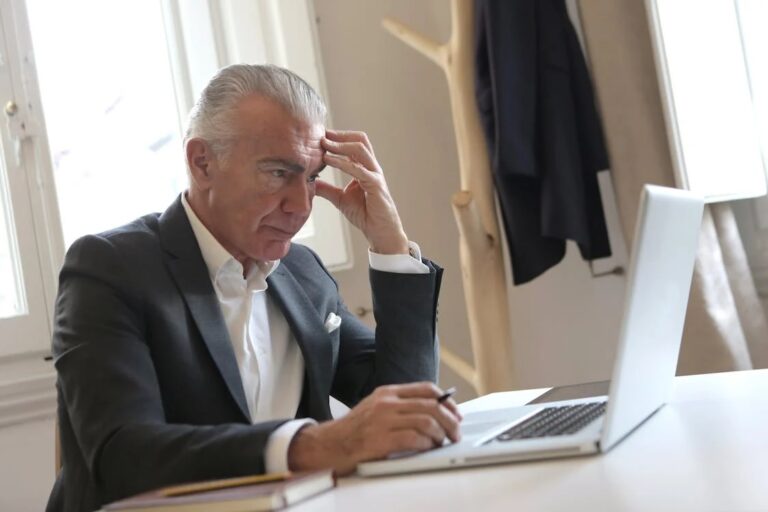

Significantly, the impact of lower earnings leads to reduced access to employer-sponsored retirement contributions, lower levels of group life and disability cover, reduced ability to invest meaningfully, and a diminished ability to benefit from compound growth over time.

Look for creative ways to generate additional income. The gig economy has made it easier than ever to earn extra money through tutoring, freelance work, renting out a room, or offering pet-sitting or delivery services. Every bit of extra income

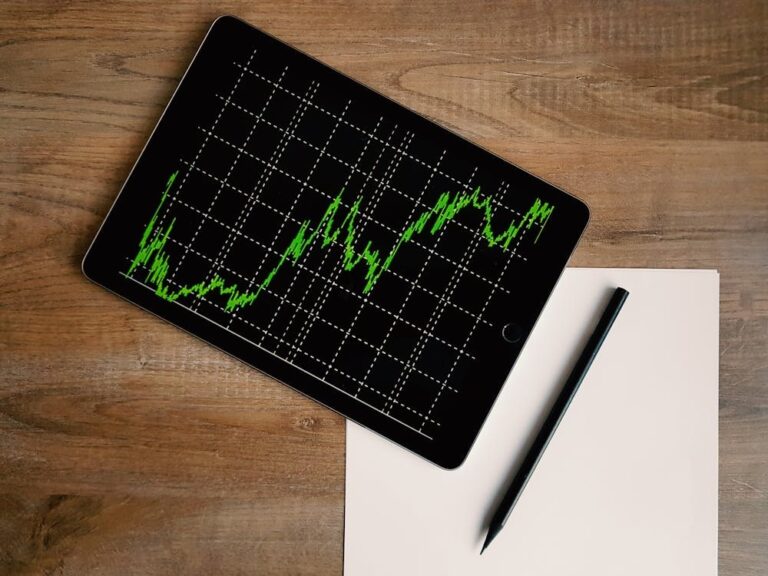

One key advantage of purchasing a living annuity with your retirement capital is that it is not subject to Regulation 28, allowing for more aggressive investment strategies, including 100% offshore exposure via Rand-denominated feeder funds. Direct offshore investing is not

If you hold both discretionary and compulsory investments, structuring your withdrawals tax-efficiently is key to preserving your wealth. You must also manage drawdowns from your living annuity carefully to prevent premature depletion of your capital or future cashflow constraints.

The financial impact extends beyond lost income—it also includes the long-term consequences of missing career advancements, and the opportunity costs associated with stepping back from work.

Most importantly, full disclosure on your insurance application form is critical to ensure that your claim is not rejected at claims stage. Remember, even a seemingly small non-disclosure which has no relation to one’s disability can result in your claim

When determining an appropriate retirement income, avoid relying on general rules of thumb. Each retiree has unique circumstances that require thorough analysis to establish an income strategy tailored to their needs. While certain expenses, such as mortgage repayments and retirement

Many retirees choose to hold on to the family home for sentimental reasons, even after their adult children have established their own households. However, if your long-term plan is to downscale to a more manageable property, it is worth considering

If leaving a financial legacy for your loved ones is important to you, you may favour the idea of a living annuity as opposed to a life annuity.